Fica tax withholding calculator

Our income tax calculator calculates your federal. Then multiply four overtime hours x 1875 15 times the hourly rate 7500.

29 Free Payroll Templates Payroll Template Payroll Checks Payroll

This calculator is a tool to estimate how much federal income tax will be withheld.

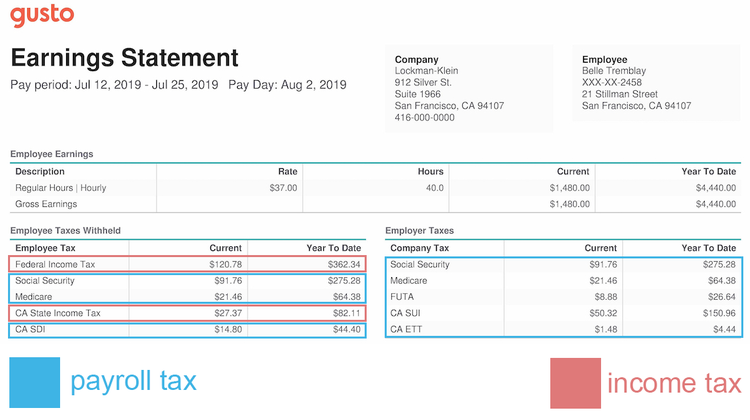

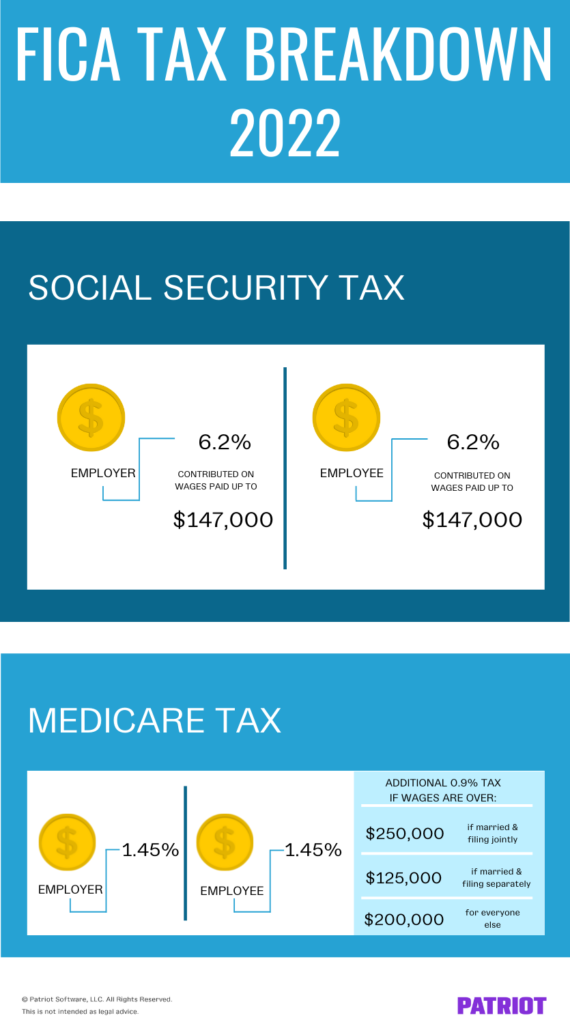

. The current rate for. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

All in all the IRS receives 153 on each employees wages for FICA tax. The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates. Michigan Income Tax Withholding Table.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your. A 62 Social Security tax. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand.

For example The taxable wages of. Ask your employer if they use an automated. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

FICA mandates that three separate taxes be withheld from an employees gross earnings. And you contribute a matching. Social Security and Medicare Withholding Rates.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Determine the amount of pay.

OASDI has been more commonly be known as Federal Insurance Contributions Act FICA. To determine Michigan tax withholding. The FICA tax is a US.

2 or 62 would be deducted from the employees gross earnings and would be filed with the IRS. FICA Tax Calculation To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax. How Your Paycheck Works.

There is no wage limit for Medicare. To change your tax withholding amount. This is a projection based on information you provide.

This tax is referred to as Old Age Survivors and. Add 500 75 for a total of 575 in gross wages for the week. HI has more commonly known as Medicare.

2 or 62 would be applied against the employers payroll tax for that cycle. You withhold 765 of each employees wages each pay period. 62 Social Security tax withheld from the first 142800 an employee makes in.

2022 Federal Tax Withholding Calculator. For 2017 the OASDI FICA tax rate is set at 62 of. Federal income tax and FICA tax.

Federal payroll tax paid by employees and their employers. And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your employer would have paid if. The Social Security FICA tax is based on the first 137700 paid at the rate of 62 with a maximum.

How To Determine Your Total Income Tax Withholding Tax Rates Org

Easiest 2021 Fica Tax Calculator

Payroll Tax Vs Income Tax What S The Difference

Federal Income Tax Fit Payroll Tax Calculation Youtube

Easiest 2021 Fica Tax Calculator

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Tax Withheld Calculator Shop 57 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

What Is Fica Tax Contribution Rates Examples

Tax Witheld Calc Sale 53 Off Www Wtashows Com